Minnesota minimum wage report 2021

By David Berry, Brian Zaidman, Ender Kavas and Gideon Ondieki – December 2021

Contents

-

Actual minimum wages for Minnesota, Minneapolis and St. Paul

-

The minimum wage relative to hourly earnings in manufacturing

-

The minimum wage relative to hourly wages of nonfarm workers

Introduction and summary

With the introduction of municipal minimum wages in Minneapolis and St. Paul (all slated to reach $15.00 an hour at various points in the 2020s), the minimum wage in Minnesota has become a more nuanced issue. The effective minimum wage – the rate employers are required to pay to covered employees – is the highest of any applicable federal, state or local rate. To understand and appreciate minimum wages in Minnesota, one should compare the new municipal minimum wages with the federal and state minimum wage rates, how these rates have changed and how they will change, relative to prices and other wages over time. This report presents data about these questions.

The following is a summary of findings.

-

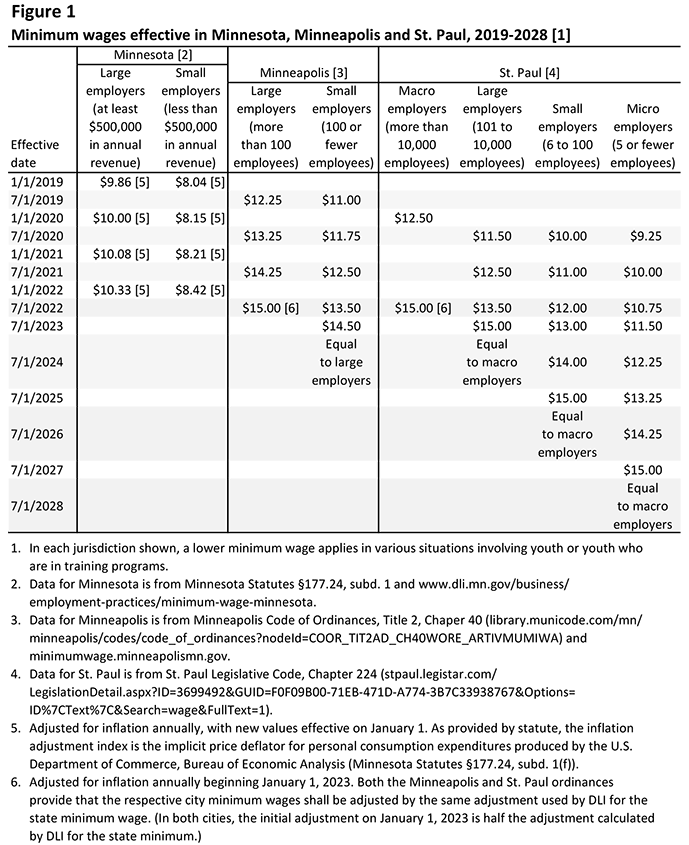

Actual minimum wages for Minnesota, Minneapolis and St. Paul – The Minnesota minimum wage, $10.08 an hour for large employers in 2021, is adjusted annually for inflation. The minimum wages for employers of different sizes in Minneapolis and St. Paul will reach $15.00 in various years from 2022 to 2027, and will be adjusted for inflation thereafter (Figure 1).

-

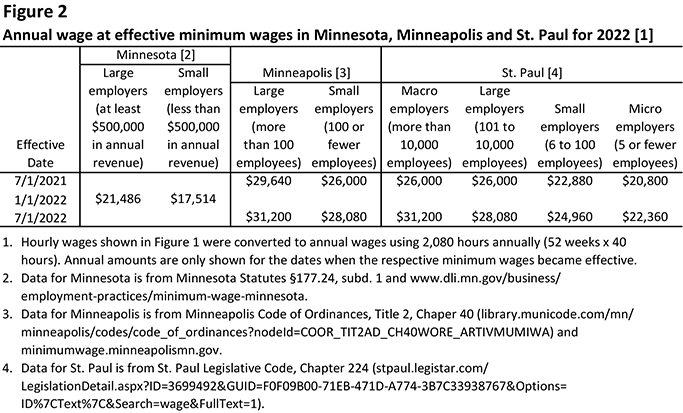

Actual annual earnings at the minimum wage – For workers earning the Minnesota minimum hourly wage and working 40 hours a week, annual wages in 2021 are $20,966 for workers at large employers and $17,077 for workers at small employers. As of July 1, 2021, workers in Minneapolis earn annual full-time wages of $29,640 at large employers and $26,000 at small employers, while St. Paul workers earn $26,000 at large employers and $22,880 at small employers (Figure 2).

-

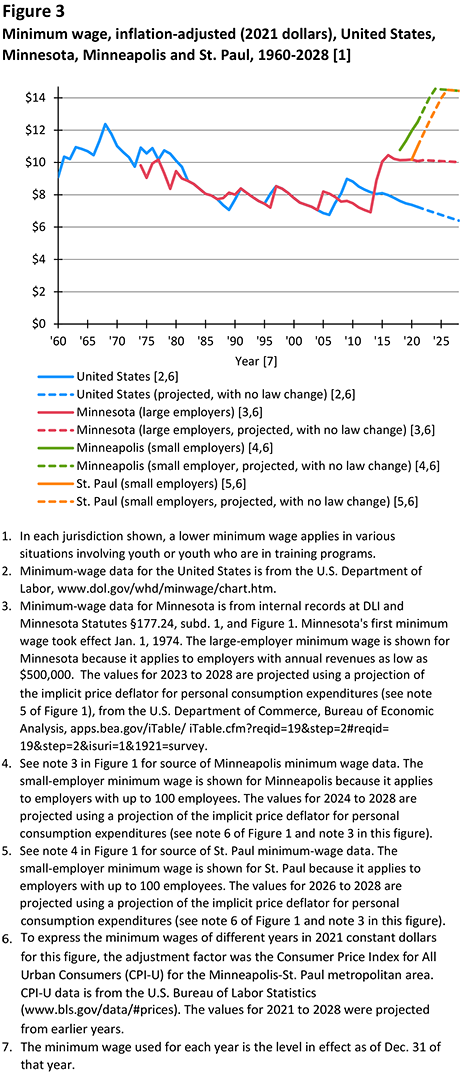

Inflation-adjusted minimum wages – Adjusting for inflation, the 2021 Minnesota large-employer minimum wage of $10.08 an hour is somewhat below the average rate of the federal minimum wage for 1960 through 1980, which was $10.66. When the Minneapolis and St. Paul minimum wages reach $15.00, they will be higher, adjusting for inflation, than the $12.37 peak reached by the federal minimum wage in 1968 (Figure 3).

-

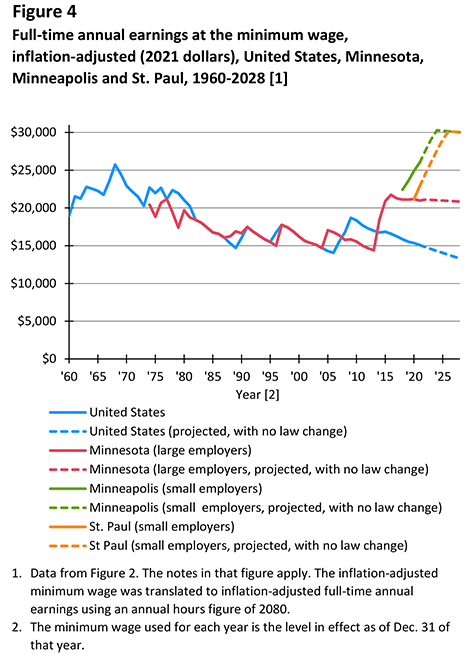

Inflation-adjusted annual earnings at the minimum wage – At the 2021 Minnesota large-employer minimum wage of $10.08, a full-time worker would earn about $20,966 annually. After the transition periods, full-time annual earnings at the small-employer minimum wages will reach $30,281 in Minneapolis in 2024, and $30,152 in St. Paul in 2026, in 2021 dollars (Figure 4).

-

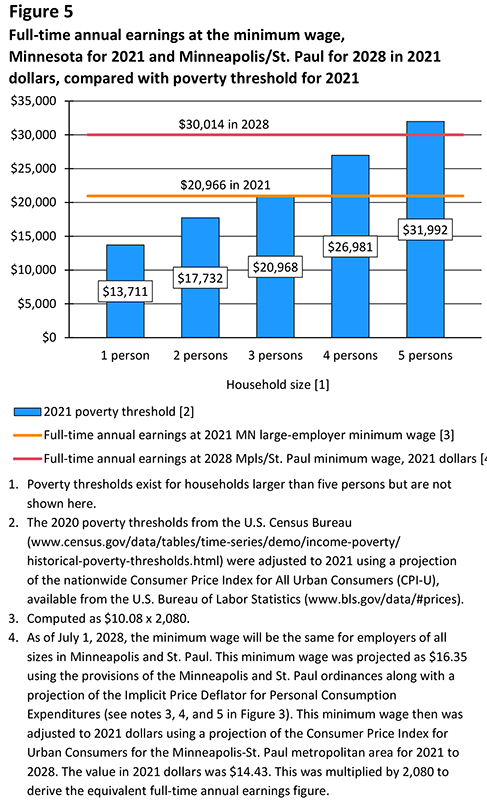

The minimum wage relative to the poverty line – At the Minnesota large-employer minimum wage, full-time annual earnings are about equal to the poverty threshold for a three-person household. At the Minneapolis and St. Paul minimum wages for 2028, full-time annual earnings will fall about midway between the poverty thresholds for households of four and five persons (Figure 5).

-

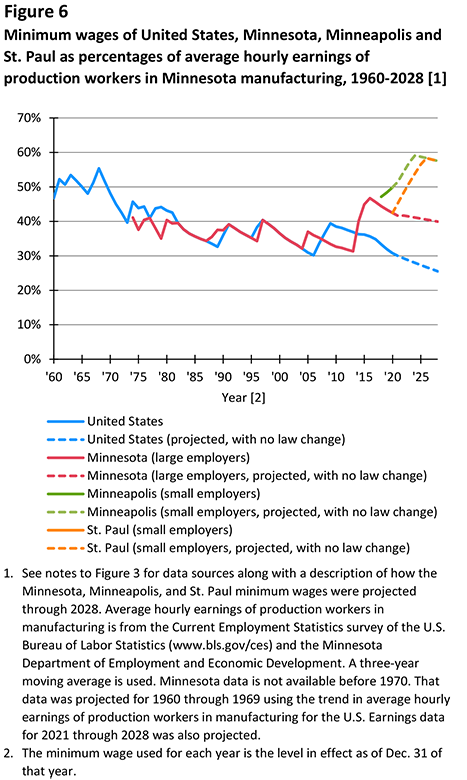

The minimum wage relative to hourly earnings in manufacturing – Relative to average hourly earnings (AHE) of production workers in Minnesota manufacturing, the federal minimum wage peaked at 55% in 1968. After the transition periods in Minneapolis and St. Paul, the $15.00 minimum wages in the two cities will stand at roughly 58% of manufacturing AHE (Figure 6).

-

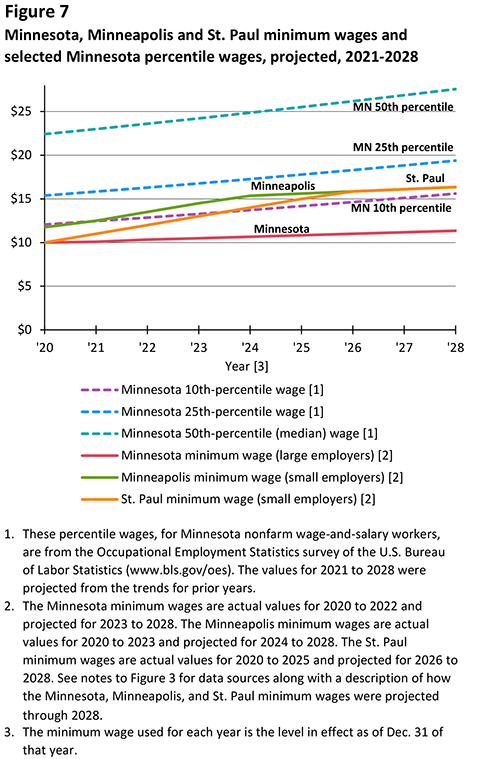

The minimum wage relative to hourly wages of nonfarm workers – The 2021 Minnesota large-employer minimum wage of $10.08, as adjusted for inflation in future years, is running at less than the 10th percentile of hourly wages of nonfarm wage-and-salary workers in Minnesota. After the transition periods in Minneapolis and St. Paul, the minimum wages in those cities will be about midway between the 10th and 25th percentiles of overall nonfarm wages in the state (Figure 7).

Actual minimum wages for Minnesota, Minneapolis and St. Paul

Figure 1 shows the minimum wage rates effective in Minnesota and the cities of Minneapolis and St. Paul for 2019 to 2028. As of Jan. 1, 2021, the Minnesota minimum wage is $10.08 for large employers (see figure for employer size definitions) and $8.21 for small employers. On Jan. 1, 2022, it will be adjusted for inflation, increasing to $10.33 for large employers and $8.42 for small employers.1

Under the Minneapolis and St. Paul minimum wage ordinances, the minimum wages in the two cities will reach $15.00 under different timelines depending on employer size. The Minneapolis minimum wage for large employers will rise from $14.25 as of July 1, 2021 to $15.00 on July 1, 2022, and will be adjusted for inflation every Jan. 1 thereafter. The Minneapolis minimum for small employers has a more delayed phase-in than for large employers, but will attain the same rate as for large employers July 1, 2024.

The St. Paul minimum wage took effect in 2020. For large (non-macro) employers, it will reach $15.00 on July 1, 2023; small and micro employers will reach the $15.00 rate in 2025 and 2027, respectively. All employers will reach the same rate as macro employers (an indexed $15.00 minimum) by 2028.

Given the provisions of the minimum-wage ordinances in Minneapolis and St. Paul, employers of all sizes in the two cities will pay the same indexed minimum wage as of July 1, 2028.2

Actual annual earnings at the minimum wage

For workers earning the Minnesota minimum hourly wage and working 40 hours a week, annual wages as of Jan. 1, 2021, are $20,966 for workers at large employers and $17,077 for workers at small employers. Effective Jan. 1, 2022, annual wages will be $21,486 for large employers and $17,514 for small employers (Figure 2).

As of July 1, 2021, workers in Minneapolis earn annual full-time wages of $29,640 at large employers and $26,000 at small employers, while St. Paul workers earn $26,000 at large employers and $22,880 at small employers. Effective July 1, 2022, workers in Minneapolis will earn annual full-time wages of $31,200 at large employers and $28,080 at small employers, while St. Paul workers will earn $28,080 at large employers and $24,960 at small employers.

Inflation-adjusted minimum wages

Figure 3 shows the minimum wages for the United States, Minnesota, Minneapolis and St. Paul for 1960 to 2028, adjusted for inflation (in 2021 dollars). In 2021 dollars, the federal minimum wage reached a peak of $12.37 an hour in 1968.3 The current federal minimum wage of $7.25 (its rate since 2009) is not indexed for inflation. Therefore, in 2021 dollars, the value of the federal minimum wage is projected to decline to $6.40 by 2028 in the absence of any statutory increases.

In 2021 dollars, the current large-employer Minnesota minimum wage of $10.08 is higher than the U.S. and Minnesota rates of any year from 1981 through 2015, and somewhat below the average rate of the federal minimum wage for 1960 through 1980, which was $10.66. Although the state minimum wage is currently indexed for inflation, the constant-dollar value of the state minimum wage is projected to decrease slightly through 2028. This is because the Implicit Price Deflator for Personal Consumption Expenditures, which is used under statute to index the state minimum wage, is projected to increase less rapidly than the index used in Figure 3 to express the trends in constant-dollar terms – the Consumer Price Index for Urban Consumers (see footnotes 3 and 6 in Figure 3 and footnote 3 in the text).

The minimum wages shown in Figure 3 for Minneapolis and St. Paul are the small-employer minimum wages. This is because, in contrast to the provision for the state minimum wage, the small-employer categories for the Minneapolis and St. Paul minimum wages include employers with up to 100 employees (see Figure 1 and related discussion). In 2021 dollars, the Minneapolis and St. Paul small-employer minimum wages are projected at $14.43 an hour for 2028. These values are less than $15.00 because they are adjusted for projected inflation between 2021 and 2028. Nonetheless, these inflation-adjusted values are $2.06 an hour higher than the inflation-adjusted peak value of $12.37 reached by the federal minimum wage in 1968. As noted above, after the initial transition period, employers of all sizes in the two cities will have the same minimum wage (Figure 1).

As with the state minimum wage, the constant-dollar values of the Minneapolis and St. Paul minimum wages are projected to decrease slightly over time after inflation-indexing has begun (after 2024 and 2026, respectively, for the small-employer minimum wages in the two cities). The reason is the same as with the state minimum wage (see above).

Inflation-adjusted annual earnings at the minimum wage

Figure 4 shows full-time annual earnings at the minimum wages for the United States, Minnesota, Minneapolis and St. Paul for 1960 to 2028, adjusted for inflation (in 2021 dollars). This figure is identical to Figure 3 except for the scaling of the left axis (see footnote 1 in Figure 4).

Where the federal and state minimum wages are concerned, inflation-adjusted full-time annual earnings reached a peak of $25,739 in 1968 at the federal minimum wage. At the state minimum wage (for large employers), full-time inflation-adjusted annual earnings are currently $20,966. At the small-employer minimum wages in Minneapolis and St. Paul, full-time annual earnings, in 2021 dollars, are projected to reach $30,281 in Minneapolis in 2024 and $30,152 in St. Paul in 2026.4

The minimum wage relative to poverty thresholds

Figure 5 compares minimum-wage earnings to estimated poverty thresholds (projected to 2021) for households of different sizes. At the Minnesota large-employer minimum wage for 2021, full-time annual earnings – $20,966 in 2021 dollars – were above the poverty thresholds for one-person and two-person households, and equal to the poverty threshold for a three-person household. At the 2028 minimum wage for Minneapolis and St. Paul (see footnote 4 in Figure 5), full-time annual earnings are projected to be about midway between the poverty thresholds for four-person and five-person households when adjusted to 2021 dollars.5

The minimum wage relative to hourly earnings in manufacturing

It is also relevant to gauge the level of the minimum wage relative to other wages. Figure 6 expresses the minimum wages of the United States, Minnesota, Minneapolis and St. Paul as percentages of average hourly earnings (AHE) of production workers in Minnesota manufacturing for 1960 to 2028.6

As a percentage of manufacturing AHE, the federal minimum wage reached a peak of roughly 55% in 1968. The Minnesota minimum wage for large employers has been less than that level for its entire history; at its current rate, the Minnesota minimum wage of $10.08 is about 42% of manufacturing AHE, which is projected to be around $24 in 2021.

As to the Minneapolis and St. Paul minimum wages for small employers, a pattern arises similar to those in Figures 3 and 4. The initial rates of these minimum wages ($10.25 in Minneapolis for 2018 and $10 in St. Paul for 2020) were less than 50% of manufacturing AHE. However, by the time the Minneapolis and St. Paul minimums reach $15.00, they will be about 59% and 57% of manufacturing AHE, respectively. Both will be above the 55% level reached by the federal minimum wage in 1968.

The minimum wage relative to hourly wages of nonfarm workers

Figure 7 gives another perspective on minimum wages relative to other wages in Minnesota. It shows the minimum wages for Minnesota, Minneapolis and St. Paul against different percentile hourly wages for Minnesota nonfarm wage-and-salary workers for 2021 to 2028.

For the entire period shown, the Minnesota large-employer minimum wage is less than the 10th-percentile wage of Minnesota nonfarm wage-and-salary workers. The Minneapolis and St. Paul small-employer minimum wages begin at rates at or below the 10th percentile and then rise, eventually running about midway between the 10th and 25th percentiles of overall nonfarm wages in the state.7 For instance, by 2026, the Minneapolis and St. Paul small-employer wages are projected to reach $15.85, which will be below the 25th-percentile wage of $18.29 for Minnesota nonfarm wage-and-salary workers.

Endnotes

1Note the definition of "small employer" is different for Minnesota than for either Minneapolis or St. Paul. For Minnesota, small employers are those with less than $500,000 in annual revenue. For Minneapolis and St. Paul, small employers are those with 100 or fewer employees (and more than five employees for St. Paul). According to data from the U.S. Small Business Administration, businesses in 2012 with one to four employees had an average of $406,000 in annual revenues (advocacy.sba.gov/small-business-data-resources). Extrapolating from this, a business with five employees would have an average of more than $406,000 in annual revenues. Thus, the $500,000 dividing line between "small" and "large" for Minnesota is at the lower end of "small" for Minneapolis or St. Paul (and near the line between "small" and "micro" for St. Paul). In other words, many employers that would be "large" for Minnesota would be "small" for Minneapolis or St. Paul.

2The provisions at issue are: (1) the large-employer minimum wage in Minneapolis and the macro-employer minimum wage in St. Paul will both reach $15.00 on July 1, 2022; (2) the provisions for inflation-indexing are the same in the two cities; and (3) the minimum wages for all employers in the two cities will eventually reach the large-employer rate in Minneapolis and the macro-employer rate in St. Paul.

3This report uses the expression "adjusted for inflation" to refer to the statistical adjustment of the minimum-wage amounts for different years in this report to express them in constant 2021 dollars to analyze how they have changed, and will change, over time in purchasing-power terms. This adjustment uses the Consumer Price Index for the Minneapolis-St. Paul Metropolitan Area. This is different from the indexing of the Minnesota, Minneapolis and St. Paul minimum wages under statute and ordinance, which generally increases them each year (or will increase them each year when this provision becomes effective for Minneapolis and St. Paul). This indexing uses the nationwide Implicit Price Deflator for Personal Consumption Expenditures.

4As in Figure 3, there is a slight downward drift in the constant-dollar values of the Minnesota minimum wage after 2020 and of the Minneapolis and St. Paul minimum wages after inflation-indexing has begun for them. As in Figure 3, the reason is the index used to increase the state and city minimums is projected to increase less rapidly than the index used in Figure 4 to express the trends in constant-dollar terms.

5The comparison would be the same if the poverty thresholds and earnings amounts were expressed in 2028 dollars.

6It would be preferable to use a broader wage measure, ideally the average or median wage of the overall state economy, as the basis for comparison, but such a measure is not available for the period concerned.

7Raising the minimum wages in Minneapolis and St. Paul will eventually raise the lower portion of the wage distribution and the Minnesota 10th-percentile wage.